Last updated:

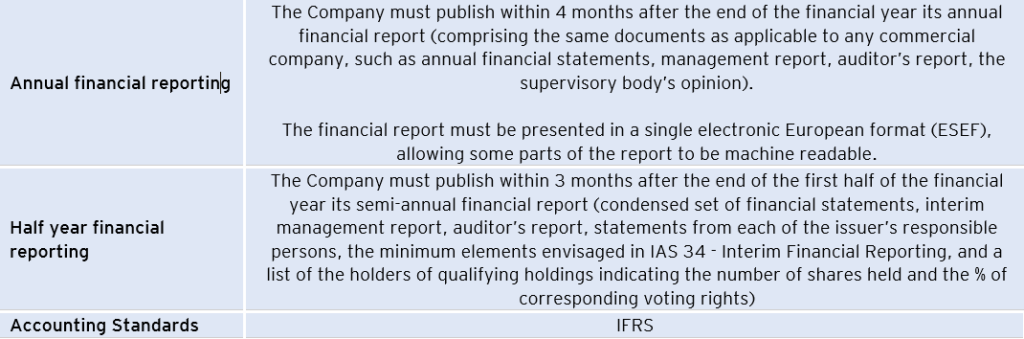

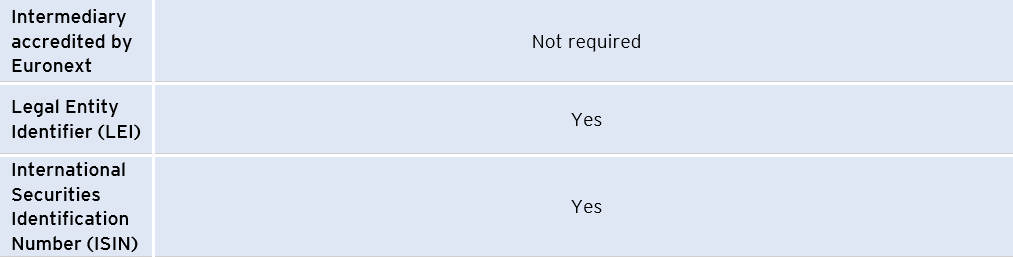

Periodic disclosure obligations

In order to provide an overview on the ongoing main activities and development of their business strategy, there are a few of disclosure obligations that must be fulfilled by listed companies.

In particular, listed companies are required to periodically disclose:

1. Financial information

Before disclosing the financial report and being already aware of the results, the Company shall assess the need to disclose an inside information statement (results announcement) pointing out the main relevant features of its financial information, in order to ensure that all investors are provided at the same time with the relevant financial information data.

How should the information be disclosed?

The required information, as well as any amendments or rectifications, must be disclosed on CMVM’s website, prior to disclosure by other means. Issuers receive access credentials following an IPO or admission to trading of their securities.

2. Non-financial information

Large companies which at the closing date of their balance sheet exceed an average number of 500 employees during the financial year, must include, in addition to its financial statements, a non-financial statement in their management report.

Large companies are those which exceed at least two of the following three thresholds:

This non-financial statement must contain information that makes it possible to understand the evolution, performance, position, and impact of the Company’s activities, regarding at least environmental, social and employee-related issues, gender equality, non-discrimination, respect for human rights, combating corruption and bribery.

Where a Company has no policies in place with respect to one or more of the above issues, the non-financial statement should provide a clear and reasoned explanation as to why this is the case.

In order to facilitate the preparation of this report, the CMVM has prepared a template that may be used to comply with this obligation, although its use is not mandatory (Modelo_INF_cons_pub_6_2020.pdf).

This information has become increasingly important for investors and stakeholders in general. By disclosing such information the Company provides the public with relevant data that allow them to compare the way that the companies where they invest or intend to invest addresses these matters and the manner according to which they affect or impact the Company’s purpose, strategy and its businesses.

3. Corporate governance

Corporate governance practices are some of the most elementary features of the Company’s ability to prosecute its purpose. Dedicating time and effort to the process of implement the best practices with regards to internal procedures might represent the difference between having a resilient long-term structure or incurring in potentially undesirable risks emerging at any time.

Corporate Governance standards derive from the Portuguese Companies Code; the Portuguese Securities Code; CMVM Regulation no. 4/2013 and the Corporate Governance Code of the Portuguese Institute of Corporate Governance (IPCG).

Duties related with the convening of general shareholders meetings

Regarding the public Company’s general governing bodies refer to section ‘3.1.1.2.1.2. Adapt corporate governance structure and internal compliance functions’ for further detail to check the Company’s obligations, such as the notice for convening the General Meeting and following information that must be provided to the shareholders by the Company.

Reporting duties on corporate governance practices: Annual Information on Corporate Governance

Companies must disclose, either as a chapter in their annual management report or as an appendix, a detailed report on their Corporate Governance structure and practices. CMVM Regulation 4/2013 presents the order and the information that should be disclosed, for instance:

The Corporate Governance Code of IPCG includes a set of recommendations (soft law) regarding the organisational structure and corporate bodies, remuneration, auditing, risk management, conflicts of interest and related parties’ transactions. The current Code is part of a self-regulatory approach based on the “comply or explain” principle, according to which companies are expected to follow the recommended recommendations but have the possibility to deviate from one or more of these recommendations, due to specific reasons, provided that they set out in their corporate governance report the reasons for this practice.

Remuneration report

The management body of the Company must draw up a clear and comprehensible remuneration report, including all benefits awarded or due during the last financial year to each member of the management and supervisory bodies, according to the remuneration policy referred to in 3.1.1.2.1.2. Adapt corporate governance structure and internal compliance functions.

The remuneration report must contain information on the remuneration of each management and supervisory body member, for instance:

Gender equality promotion

There are established thresholds for companies with shares admitted to the regulated market regarding the proportion of persons of each gender appointed to each Company’s administration and supervisory body, as well as annual plans to achieve equal treatment for women and men, further detailed in section ‘3.1.1.2.1.2. Adapt corporate governance structure and internal compliance functions’.

4. Ad hoc disclosure obligations

Being a listed Company implies that the development of the business might bring specific milestones of relevance to shareholders and other potential investors which may be important for their decision to invest or divest in the Company. As such, the existence of a widespread community of investors as well as the need to ensure simultaneous access to relevant information, justifies the imposition of certain ad hoc information disclosure duties whenever some relevant events occur.

Under such circumstances, the Company is promptly required to disclose such relevant information, for instance inside information, trading of own shares, management transactions, as well as information on the evolution of its share capital structure (i.e. qualifying holdings).

Inside information, own shares and management transactions

Qualifying holdings and shareholders agreements

The shareholders must inform the Company and the CMVMC when they reach, exceed, or fall below certain holding thresholds, of 5%, 10%, 15%, 20%, 25%, 1/3, 1/2, 2/3 and 90%, of the voting rights corresponding to the share capital.

Upon the shareholders disclosure, the Company must disclose this information to the public, as soon as possible, and within 3 trading days. This information must be sent to CMVM’s information dissemination system.

The Company and its Board members must inform the CMVM whenever they have evidence of a breach of the disclosure duties regarding the capital or the threshold of shareholders’ voting rights.

In addition, shareholders agreements targeted at acquiring, maintaining, or increasing a qualifying holding in a Company issuing shares admitted to trading on a regulated market, or for supporting or deterring a takeover bid shall be reported to the CMVM by any party to the agreement within three days from execution thereof. To the extent that the agreement is relevant to control the Company, the CMVM shall order publication thereof, in whole or in part.

Related party transactions

Companies with shares admitted to trading on a regulated market must have an internal procedure through which the supervisory body periodically verifies whether the transactions with related parties are carried out within the scope of their current activity and under market conditions. This internal procedure must be approved by the Board of Directors or the executive Board of Directors and must be preceded by a prior binding opinion of the supervisory body.

Related party transactions that do not comply with the previous requirements are subject to deliberation by the Board of Directors, or by the executive Board of Directors, preceded by an opinion of the supervisory body of the Company. Additionally, those transactions whose value corresponds to 2.5% or more of the consolidated assets of the Company (or of the individual assets if they do not prepare consolidated accounts), must be publicly disclosed by the Company no later than the time at which they are carried out.

The monitoring and control of these kind of transactions are a key feature to provide investors with transparency on the nature, volume and extent of the relations established by the Company towards related parties (e.g. shareholders). Full disclosure and compliance with rules and best practices are essential to promote investors’ confidence on the inexistence off privileged transactions that could affect the Company’s value.

Other requirements regarding disclosure of information to the public

The Company must immediately inform the public of:

Corporate or Securities events

The Company must inform Euronext of corporate or securities events concerning its securities admitted to trading at least 2 trading days in advance of the earlier of:

Such events include:

Company’s website

The Company must maintain an updated website with all the information published on CMVM’s website, as well as all the information that might be relevant to shareholders.

Considering that the website is an universal and real time communication tool, issuers usual attention should focus on the disclosure of the legally required information as well as an easy and fast access to the relevant information required by investors.

5. Other obligations

Mutual cooperation with CMVM and Euronext

Both CMVM and Euronext will be cooperative with the Issuer, being continuously available to provide assistance and reply to any queries – CMVM may be contacted through Issuers Department (+351 213 177 079 or [email protected]).

Whenever listed on any market, the Company must also be open and cooperative with CMVM and Euronext, providing full and prompt responses to requests, as well as complying with the reporting duties set up in the applicable laws.

Additionally, issuers on the Regulated market must appoint a representative for market and CMVM relations.